Moneyfarm Review – Features, Fees, and Performance

In this Moneyfarm review, we look at the features, fees, and performance that this application offers its users and decide whether it is worth using.

Moneyfarm is a digital application designed to invest, an easy thing to do for all persons. However, most people tend to shy away from actually coming up with investments. This is because the investment does not seem lucrative for everyone, especially those who are considering it for the first time. This Moneyfarm review looks at the features, fees, and performance that this application offers its users and decides whether it is worth using.

Table of Contents

However, with the help of modern technology, applications like Moneyfarm have been designed to make it easy for beginners. All the tools needed to make the first investment are at the user’s disposal through this application. Making investments is no longer considered a game played by the rich, and currently, anyone can decide on which investments they wish to make. Let’s move directly to this financial service review.

Moneyfarm Review – What Is Moneyfarm

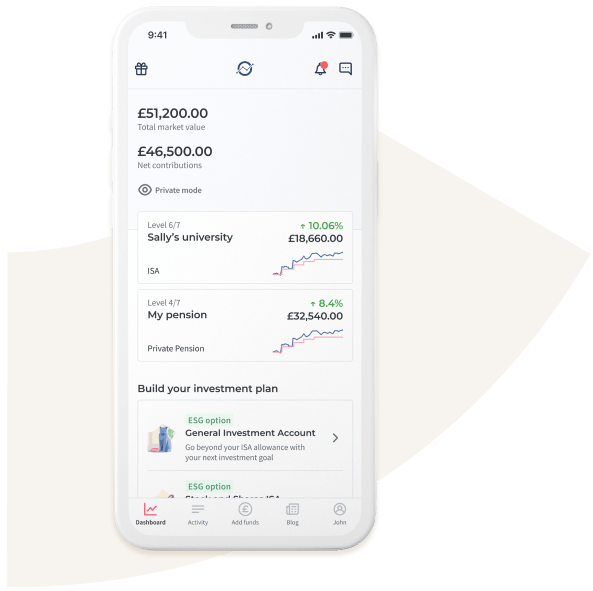

Moneyfarm is an online-based investment platform that is cheap, accessible, and available to everyone. It operates on the Robo-advisor platform, meaning that it takes its users’ money and invests it for them. Moneyfarm has three main products in its investment portfolio: stocks and shares ISA, a pension investment account, and a general investment account.

With these three products, the minimum amount that any person can choose to invest is £1,500. However, there are still several other options to choose from for those who wish to start small. These alternatives can be located in the stocks and shares comparison table.

An in-house risk assessment is a questionnaire designed to be in line with the risk portfolio of its users regarding investing. Even though users can choose an investment that they are comfortable with, they should understand that every product they go with is attached to an in-house risk assessment. Through this Moneyfarm review UK, users will get an idea of how to use this in-house risk assessment for their benefit.

How Does Moneyfarm Work?

In theory, it is advantageous to invest in stocks and shares instead of bonds since it is expected to bring forth better returns. While this is true, to a significant extent, investors should know that better opportunities attract more risk. In such an instance, investors may find themselves waiting months for their investment to gain momentum were the market to drop.

When signing up for Moneyfarm, users must accurately fill in a form that determines their investor’s profile. This profile will be the first step for Moneyfarm to recommend what portfolio to choose for its users.

Each person has his/her own preferences when averting risk, and Moneyfarm leaves this choice to the investor. Once this form is duly filled up, Moneyfarm will assign the potential investor one out of six different risk profiles, after which the user will then choose an account from the three options available.

Once this is done, it remains to the Moneyfarm investor to fund their account, which they can do through either a bank transfer or a credit card. Importantly, Moneyfarm is easy to operate. All activities on the platform start with a Moneyfarm login and follow the leads that follow. Below are the features from this Moneyfarm review.

Moneyfarm Review – Features

Product Choice (General Investment)

The main features that Moneyfarm has to lie in the products it offers its investors. Investors can either choose a General Investment that allows them to flexibly invest and withdraw their money any time they wish. However, since their investments are not in ISA, they may be expected to pay capital gain tax on their profits.

Stocks and Shares

Stocks and Shares ISA is another product that allows investors to be tax-free and still enjoy the flexibility of withdrawing their money anytime they want. Users can also transfer an existing ISA to Moneyfarm if they already have one open with another firm. Let’s go forward to the next feature from this Moneyfarm review.

Pensions

The third product is Pensions, whereby investors prepare for their retirement. With this product, users will receive tax relief on the contributions that have been paid. Through Moneyfarm, investors have the opportunity to transfer all their pensions into the same spot.

Custom Portfolios

Moneyfarm does not let its potential investors choose an investment blindly. Moneyfarm ensures that its users choose the right investment to match their most comfortable risk through the stocks and shares comparison table. In this case, users who do not know what investment suits them are helped with this feature.

Investment Advice and Strategy

Moneyfarm offers its investors digital investment advice through a personal investment consultant. Investors will then select a strategy that works for them through this investment advice.

Moneyfarm Review – Fees

Moneyfarm charges its users fees based on the amount that they invest. In general, smaller investments incur a higher fee charge than bigger investments. Therefore, the investment details have been tabled below.

| Investment Amount | Charge |

| £0 – £10,000 | 0.75% |

| £10,001 – £19,999 | 0.70% |

| £10,001 – £19,999 | 0.65% |

| £50,000 – £99,999 | 0.60% |

| £100,000 – £249,999 | 0.45% |

| £250,000 – £499,999 | 0.40% |

| £500,000+ | 0.35% |

Apart from the above fees, investors are also charged a Fund Fee and a Markey Spread Fee. The fund fee is charged by providers of ETFs at 0.20%. On the other hand, market spread refers to the difference between what the investor is willing to sell and what the buyer is willing to buy for.

Moneyfarm Review – Performance

We can say in this Moneyfarm review that the performance of Moneyfarm is very unpredictable, and it is dependent on the profile portfolio that investors select. With each investment, there are its own risks attached to it. Notably, the amount invested plays a big role in the performance of Moneyfarm. However, first-time investors should understand that a higher portfolio risk level would not guarantee them a higher return on their end. Performance of different portfolios varies over time, and so what works for one now may not work for another investor over time. An investment is expected to yield better results, and investors need to make investments based on future expectations. On the other hand, these expectations should be attached to their current needs.

Related articles: Moneybox Review | LOQBOX Review | Plum App Review

Moneyfarm Review UK – Conclusion

Moneyfarm is authorized and regulated by the Financial Conduct Authority (FCA) and is, therefore, allowed to give financial advice to investors. Through this Moneyfarm review, it is clear that it is a great option for long-term investors who are yet to have experience in managing their investments themselves.

However, it should be noted that investing is a risky business, but the potential for returns is extremely high. Therefore, before deciding to invest is made, investors should make sure that they are aware of the risks in place and the type of investment available in their portfolio to understand why certain investments are riskier than others.

Images source: Moneyfarm.com